IN THIS ISSUE

DID YOU KNOW?

TAX RATES

CHILD TAX CREDIT

EARNED INCOME CREDIT

STANDARD DEDUCTION

1099-K NEW RULES

MILEAGE RATES

CONTACT

Tax Law Updates for

Tax Season 2024

by Audrey Jackson

Did You Know?

To address the impact of inflation on taxes, the tax system includes mechanisms for indexing tax brackets, deductions, and credits to inflation. This helps maintain fairness and prevent taxpayers from facing a higher tax burden due solely to rising prices. In essence, the IRS makes annual inflation adjustments, including changes to the federal income tax brackets, standard deduction and more. Recently, based on soaring prices, the agency boosted the income thresholds for each bracket for 2023, applying to tax returns filed in 2024.

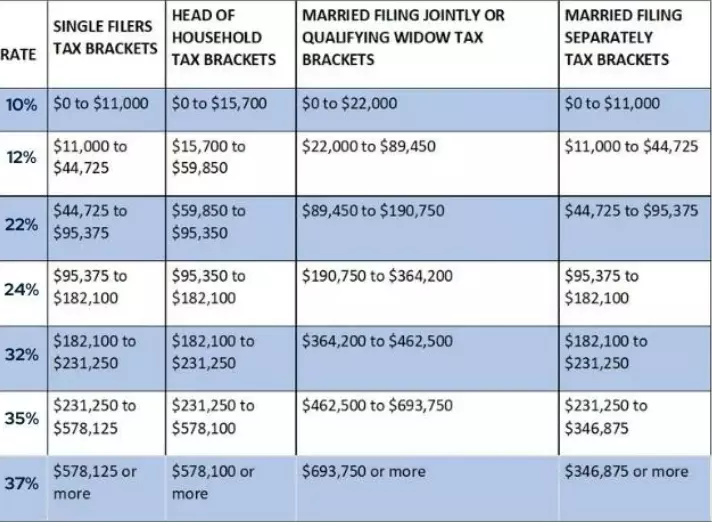

Tax Rates

There was roughly a 7% increase in the federal income tax brackets from

2022 to 2023. That was a larger increase than usual because inflation has been higher than usual.

The TCJA lowered most individual income rates, inclusive of the marginal rate from 39% to 37%.

For the taxable year beginning in 2023, the tax rate table is as shown to the left.

Child Tax Credit

The child tax credit (CTC) is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children.

For the 2023 tax year, the child tax credit is worth up to $2,000 per qualifying dependent under the age of 17.

The credit is refundable (aka ACTC), up to $1,600 when they file in 2024.

The credit amount decreases if your modified adjusted gross income exceeds $400,000 (married filing jointly) or $200,000

(all other filers).

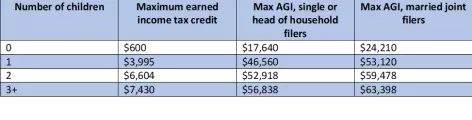

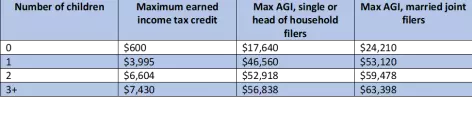

Earned Income Tax Credit

The earned income tax credit (EITC) is a refundable tax credit for low- to middle-income workers.

The credit amount depends on your earned income, filing status and number of children as seen in the chart below.

Taxpayers without children can also qualify for a lower credit amount, provided they meet the max AGI threshold.

For the 2023 tax year (taxes filed in 2024), the earned income tax credit will run from $600 to $7,430 (2022 tax year the ranges were from $560 to $6,935) depending on filing status and number of children.

The standard deduction is a fixed dollar amount that reduces the income you’re taxed on. The standard deduction amount varies depending on your income, age, whether or not you are blind, and filing status- and it changes each year.

For taxable years beginning in 2023, the standard deduction is as seen in the chart below.

The amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,250, or (2) the sum of $400 and the individual’s earned income.

For taxable years beginning in 2023, the additional standard deduction amount for the ages over 65 or blind is $1,500. The additional standard deduction amount is increased to $1,850 if the individual is also unmarried and not a surviving spouse.

Third Party Transactions (Form 1099-K) greater than $600

In 2021, Congress enacted a law requiring third-party settlement networks (PayPal, CashApp, Square, StubHub, etc.) to send Forms 1099-K to payees who are paid over $600 a year for goods and services. This reporting threshold was slated to kick in for 1099-Ks for 2022. The lower reporting thresholds received lots of criticism from across the spectrum, so the IRS decided to delay them for one year. The new rules now kick in for 2023, 1099-K forms sent out in 2024. This means more people than ever will receive 1099-K forms early next year that they will use when filling out the 2023 tax return. However, remember that 1099-K reporting is only for money received for goods and services. It doesn’t apply, for example, to people who use Zelle or Venmo to transfer money to family and friends.

In 2021, Congress enacted a law requiring third-party settlement networks (PayPal, CashApp, Square, StubHub, etc.) to send Forms 1099-K to payees who are paid over $600 a year for goods and services. This reporting threshold was slated to kick in for 1099-Ks for 2022. The lower reporting thresholds received lots of criticism from across the spectrum, so the IRS decided to delay them for one year. The new rules now kick in for 2023, 1099-K forms sent out in 2024. This means more people than ever will receive 1099-K forms early next year that they will use when filling out the 2023 tax return. However, remember that 1099-K reporting is only for money received for goods and services. It doesn’t apply, for example, to people who use Zelle or Venmo to transfer money to family and friends.

If this happens:

• Contact the issuer immediately – see FILER on the top left corner of Form 1099-K • Keep a copy of the original form and all correspondence with the issuer for your records

If you can’t get a corrected Form 1099-K, per the IRS, report the amount on Schedule 1 (Form 1040), Additional Income and Adjustments to Income.

New Standard Mileage Rates

The standard mileage rates can be used by business

owners when claiming a deduction for car and truck

expenses related to their business.

The mileage can also be used as a medical expense deduction and charitable donation deduction.

The 2023 IRS mileage rates are as follows:

- 65.5 cents per mile for business use.

- .22 per mile driven for medical or moving purposes. • .14 per mile driven for charitable purposes.